Raisex Exchange Review – all polish, no real trading

Raisex Exchange sounds solid on paper. It claims a launch year around 2017, lists Malta as its home, and talks about experienced financial founders building a secure environment for spot and derivatives. There’s mention of a native token, staking mechanics, and support for both major and emerging cryptocurrencies.

That kind of profile could be appealing. It promises the best of both worlds: European roots for regulatory peace of mind, plus crypto-native features like perpetual futures and token yields. But the deeper you look, the more obvious it becomes that Raisex is mostly marketing with no actual traction.

A platform in name only

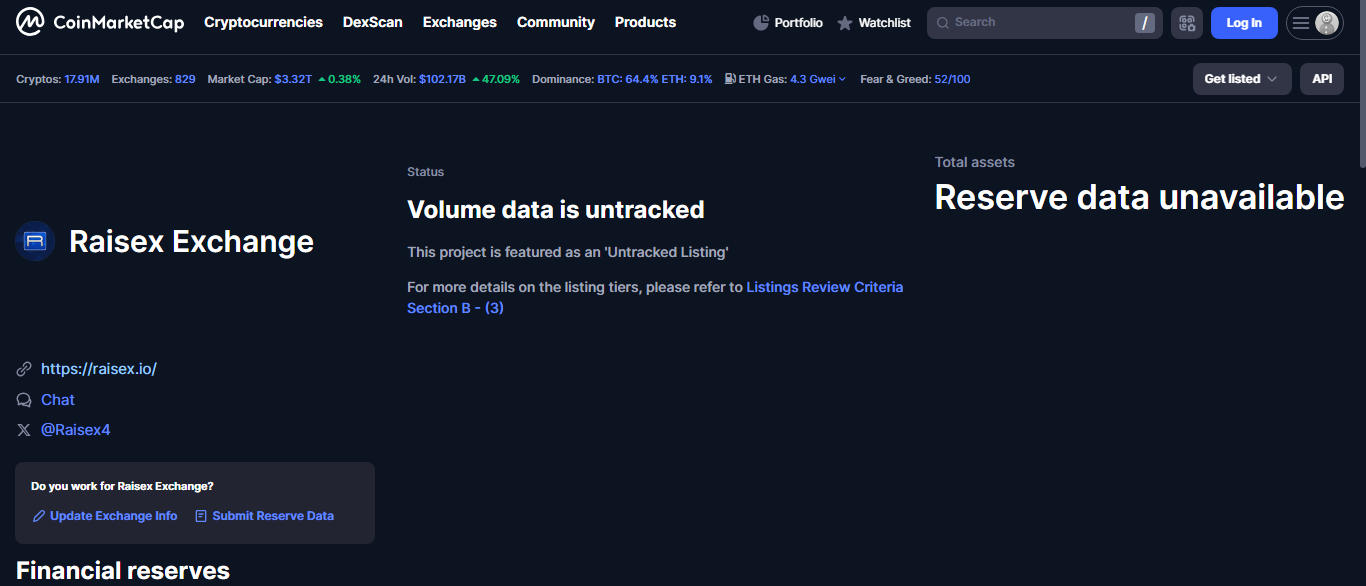

Check most basic signs of life on an exchange – daily volume, visible order books, or historical charts – and Raisex comes up empty. It’s not just low activity, it’s zero. There’s no verified turnover, no displayed bid-ask spreads, no records of trades. Essentially, it doesn’t function as a real marketplace.

This means you can’t count on liquidity for even simple transactions. Place an order to buy or sell, and there’s a good chance you’ll just sit there waiting forever because nobody’s on the other side. A marketplace without participants is like a shopping mall with empty stores – impressive architecture, but nothing inside.

Missing transparency at every level

For a site that tries to highlight its European location and seasoned founders, there’s almost nothing available to prove it. You won’t find actual names of executives, no board or leadership team, no verifiable licenses, and no public documentation showing compliance with Maltese financial rules.

That’s a big deal. Properly regulated exchanges usually show ownership structure, regulatory certificates, or links to audits and insurance coverage. Even smaller regional platforms make an effort to prove who’s in charge. Raisex doesn’t. That forces traders to rely entirely on what the website says – with no external validation.

No public reserve data or audits

Trustworthy exchanges commonly publish proof-of-reserves. They’ll show cold wallet balances, security audits, or at least partial attestations from outside firms. Raisex doesn’t share any such data. That leaves major questions about whether it even holds customer deposits, how funds are managed, and what happens if users request large withdrawals.

Without visibility, there’s no way to confirm if this exchange could survive sudden demand for funds. Or if it’s simply operating as a hollow shell with no real backing.

Community and trader voices are silent

Another major signal for any platform is the activity of its users. On active exchanges, you’ll find forums, Reddit posts, Twitter threads, or even guides and reviews by independent traders. Those users complain loudly when fees go up, celebrate new features, or dissect liquidity in detail. Around Raisex? Practically nothing.

Try looking for real testimonials and you’ll find a void. No heated debates about spread manipulation. No stories of great fills or fast support. Not even threads warning of slow withdrawals. It’s just empty space. That suggests very few – if any – real people have ever used Raisex in meaningful volume.

What Raisex promises on the surface

It’s not that the site is poorly designed. Quite the opposite. The platform showcases:

- Spot markets with top digital assets like Bitcoin and Ethereum.

- Perpetual contracts that mimic futures but roll over without expiry.

- A native token intended to fuel trading fee discounts or staking rewards.

- An interface that feels modern and responsive, with the typical trading tools.

All of that is standard for real exchanges. But it only matters when backed by volume, active wallets, and an engaged user base. Without those, these features are just placeholders.

Why some might still look at it

If you’re a developer researching different exchange frameworks, Raisex could be interesting as an example of how a professional front-end might look even if nothing happens behind it. Designers could take note of its clean layout. Beyond that curiosity value, it offers no compelling reason to deposit funds.

Who should avoid it completely

Anyone thinking about actual trading. If you plan to buy, sell, hedge, or build a crypto position, Raisex doesn’t deliver the environment you need. No liquidity means you’ll struggle to execute. No clear team or regulation means you have no fallback if money is stuck. And without a transparent audit trail, there’s nothing to guarantee your assets are even stored safely.

Bottom line on Raisex Exchange

On its surface, Raisex Exchange looks like it ticks every box. A Malta location suggests European financial rules. Promises of futures and staking add modern crypto appeal. A native token and smooth charts seem like icing on the cake.

But all of that collapses under scrutiny. There are no real users, no visible markets, no community to vouch for it, and zero independent proof of any kind. The exchange fails the most basic due diligence checks.

If you want a safe place to trade, stick to platforms with verifiable licenses, published volumes, and large communities who aren’t shy about sharing their wins and losses. Raisex is a reminder that in crypto, marketing is cheap – real trust has to be earned through openness, regulation, and consistent user activity.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”