Swych – All Interface, No Movement

Swych greets you with a modern layout. Swap panel. Wallet connect. Token search. Staking options. It’s familiar territory for anyone who’s touched a DEX. But once you move past the visuals and start interacting, something becomes obvious – nothing works. Swaps don’t complete. Volumes are negligible. Liquidity is barely there. You’re left with a frame that doesn’t do what it claims.

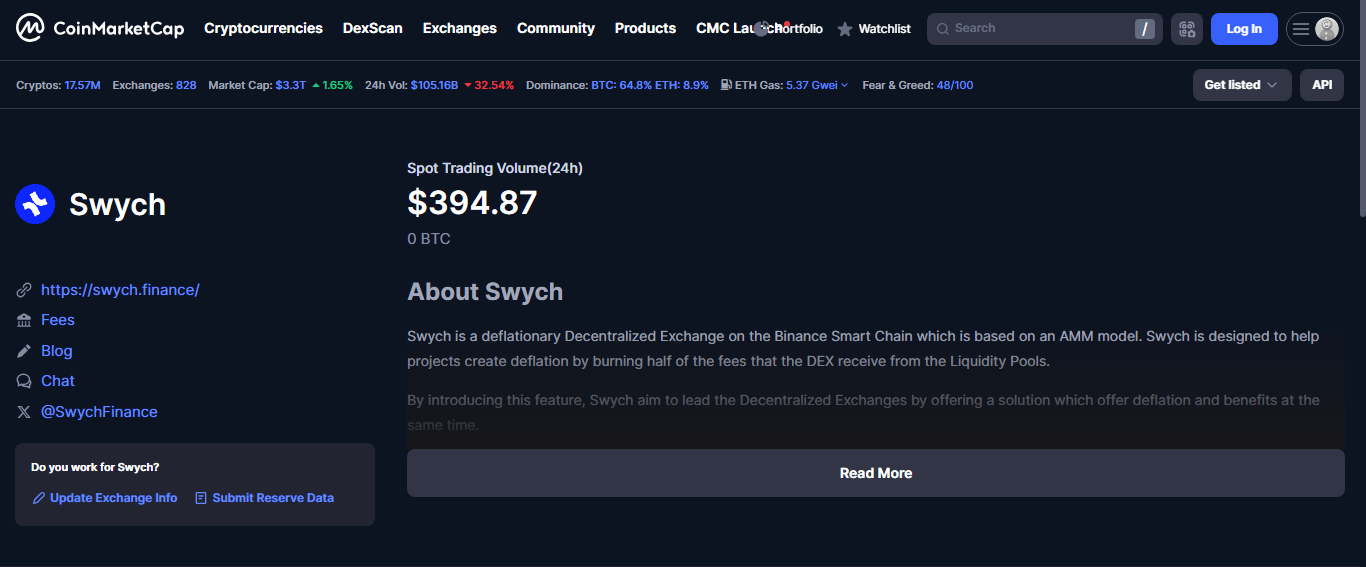

Volume That Barely Registers

Daily trading volume stays far below meaningful levels. Some reports show a few hundred dollars per day. That’s total volume, across all pairs. For an active platform, even one focused on niche tokens, that number would be much higher. Swych just isn’t being used. Traders aren’t there. Markets aren’t moving. Orders, if any, are isolated and small.

No trades means no momentum. No price movement. No opportunities. Just digital stillness.

Liquidity: Thin to Nonexistent

A major issue here is liquidity depth. Swych can list pairs and display pools, but they don’t have real backing. If you try to execute even a modest trade, the system either rejects it or produces massive slippage. Some tokens might appear swappable, but in practice, the liquidity backing them is a few dozen dollars – or none at all.

That makes real usage impossible. You can’t run trades, and you can’t expect others to do so either.

UI That Misleads

Everything looks active. The site loads fast. You can approve tokens, change slippage, toggle gas settings. Wallet balances appear. The swap button lights up. And then… nothing. The swap doesn’t go through. No transaction confirmation. No gas spent. No new token in your wallet. The interface performs, but the backend doesn’t.

This is the kind of platform that can fool a casual user into thinking their transaction is pending, when in fact, nothing happened at all.

Deflationary Mechanism – On Paper

Swych promotes a deflationary swap model: half the platform’s fees get burned automatically. That’s a clever hook. But without trades, that mechanism doesn’t fire. There’s nothing to burn if no fees are collected. So the concept might exist in contract logic, but it’s not being triggered. No evidence of consistent burning, no chain activity showing this process in motion.

The feature sounds compelling, but without usage, it’s idle.

Community with No Engagement

There are signs of life around the brand. Mentions in token spaces, social groups, occasional posts. But engagement isn’t the same as utility. A functional DEX draws users who post about slippage, staking returns, token listings. Swych has none of that. No guides. No user strategies. No screenshots of working swaps.

The absence of buzz from actual users tells the story. People aren’t trading here. They’re not interacting at all.

A Platform That’s Technically Live

Wallet connection works. Token approvals go through. Charts appear. Token search functions. But the one thing a DEX must do – facilitate swaps – doesn’t happen. There are no working markets. No farming incentives that matter. Just a collection of frontend parts that never trigger meaningful transactions.

This isn’t just inactivity. It’s non-functionality.

Who Might Still Use It?

The only users who might find value here are:

- Developers testing smart contract frontends on BNB Smart Chain

- UI/UX designers evaluating AMM templates

- Auditors or analysts reviewing how token approvals are handled

- Token holders curious about staking, though returns aren’t visible or reliable

Anyone hoping to trade, swap, or farm real tokens? They’ll leave immediately.

Danger in Polished Silence

Platforms like this are risky not because they crash – but because they seem okay. The visuals suggest a live product. Everything clicks. Buttons respond. But the underlying system does nothing. It’s misleading by design.

In crypto, that’s worse than failure. At least when a project breaks, you know what you’re dealing with. Here, it pretends to function – then offers no result.

What Needs to Change

If Swych intends to be taken seriously, several things need to happen:

- Inject real liquidity into at least a few major pools

- Show confirmed swap activity – live, visible, verifiable

- Enable transaction tracing so users can see swap outcomes

- Make the burn model public with evidence of each event

- Build a community with users sharing actual experiences

Right now, none of that exists.

Final Judgment

Swych is a case study in surface over substance. The layout is modern. The platform loads fast. The wallet integration is smooth. But that’s where it stops. No trades. No liquidity. No confirmations. No user base.

It’s not a decentralized exchange. It’s a decentralized facade.

Anyone can create a clean frontend. What matters is execution. And on that front, Swych isn’t just underdeveloped – it’s non-operational.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”