Capital DEX Overview

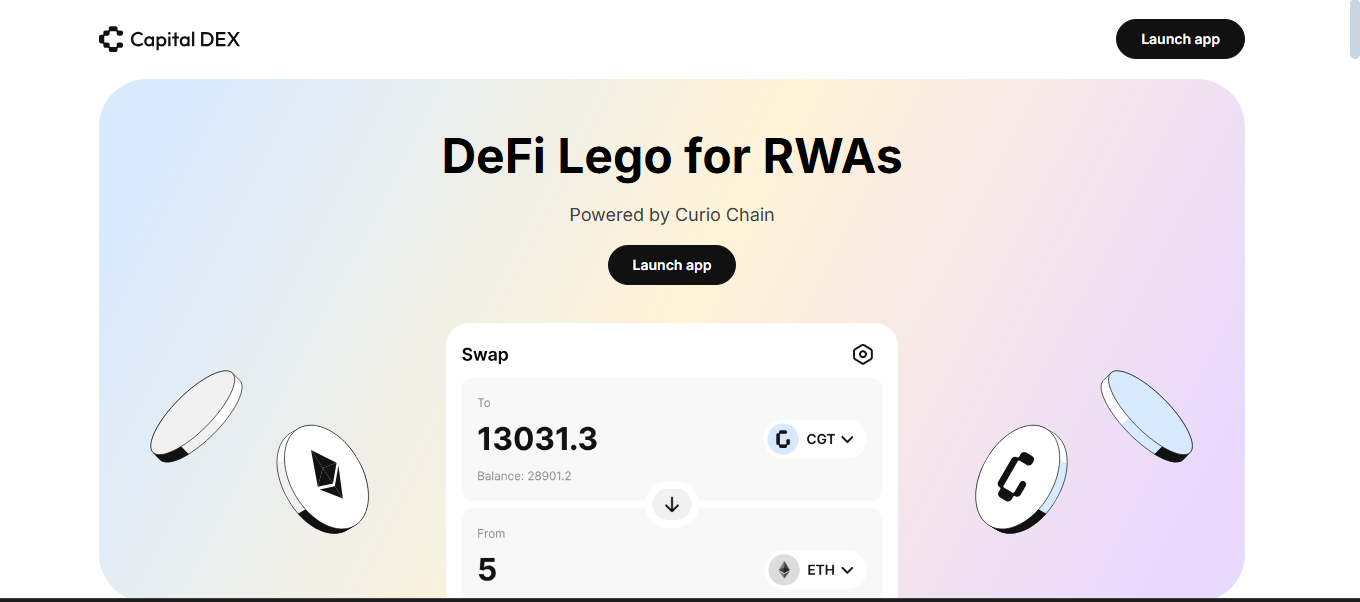

Capital DEX is one of those newer decentralized exchanges built to run across multiple EVM chains. It tries to merge the usual swap mechanics with multi-chain liquidity aggregation. The goal? Give traders a way to get better execution without hopping between a dozen different apps.

It’s another player in the expanding universe of DEX aggregators, promising more routes, tighter prices, and a dashboard that handles cross-network complexity behind the scenes.

What Sets It Apart

Unlike plain vanilla DEXs locked to a single chain, Capital DEX is built to sniff out prices across several networks and automatically route your trade through whatever path gives you the best rate. That means instead of being stuck swapping only on Ethereum or only on BNB Chain, it can combine or jump between them, pulling liquidity from different pools.

It’s basically the same aggregator concept that’s popular in platforms like 1inch or Matcha, but tailored with its own design and execution speed tweaks.

Trading Pairs & Typical Volumes

The exchange pulls together pairs from the networks it aggregates. You’ll find the usual suspects - ETH, USDT, BNB, stablecoins, plus popular mid-caps and memecoins. Because it relies on sourcing from existing pools, actual daily volume numbers bounce around based on broader DeFi activity. It’s typically smaller than the giants but enough for normal trades. Just know that if you go for obscure pairs or try to shift huge blocks, you could still run into slippage.

Costs & Fee Details

Fees on Capital DEX are split between the gas you pay on each network (which varies a lot) and a small aggregator service cut, often around 0.1% or less. Since it routes through multiple DEXs, the total cost sometimes ends up a bit higher than if you manually hunted for the cheapest swap yourself. But you’re paying for the convenience of it doing the legwork and often reducing failed transactions.

How Safe or Risky?

It’s a standard non-custodial setup. You connect a wallet - MetaMask, Trust, whatever - and approve trades directly. Your assets never sit on Capital DEX itself. Smart contracts handle the routing, and the protocols tapped for liquidity are generally established pools. Of course, there’s still smart contract risk. Any aggregator means you’re trusting multiple layers of contracts, plus the bridges if it hops chains.

Adding & Moving Funds

There’s no direct fiat ramp. You’ll need to come prepared with crypto on one of the supported chains. From there, connect your wallet, pick your swap, and confirm. If it has to bridge funds between chains, it usually handles that under the hood, though you’ll still sign multiple approvals. It makes DeFi a bit simpler, but you’re still in charge of making sure your wallet’s loaded up.

Highlights & Weak Spots

Highlights:

- Searches across multiple chains for better rates

- Easy for wallet users - no sign-ups, no KYC

- Pulls liquidity from many pools, sometimes tightening spreads

- Stays non-custodial, you keep your keys

Weak spots:

- Not great for absolute beginners - no fiat on-ramps, more to learn

- Slightly higher total cost vs. manual swaps if you know where to look

- Relying on multiple smart contracts means layered risk

- Volumes can thin out on niche or experimental pairs

Compact Comparison Table

Who Might Actually Use It

This is mostly for folks already comfortable in DeFi. If you’re tired of checking rates on three different DEXs before every trade, it’s a handy way to let an algorithm do it. Same if you’re managing tokens on multiple networks and want swaps to just work without manually bridging and guessing prices.

Final take

Capital DEX doesn’t reinvent DeFi, but it does smooth out some hassles. If you’re juggling wallets across chains, it can save time and missed price moves. It’s still DeFi though - no fiat, no big customer support teams, and the usual risk of bugs. For traders who like chasing small edges or just want simpler cross-chain swaps, it earns a spot in the toolkit.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”

.png)

%203.svg)

%203.svg)