Cube Exchange - Exchange Review

Speed Meets Security

Cube Exchange aimed to combine the best of centralized and decentralized systems. The platform features a high-speed matching engine capable of microsecond-level executions, paired with MPC-powered vaults that give traders control over their own assets. A Guardian network of trusted third parties validates withdrawals - creating a safety net uncommon among exchanges.

Trading Features

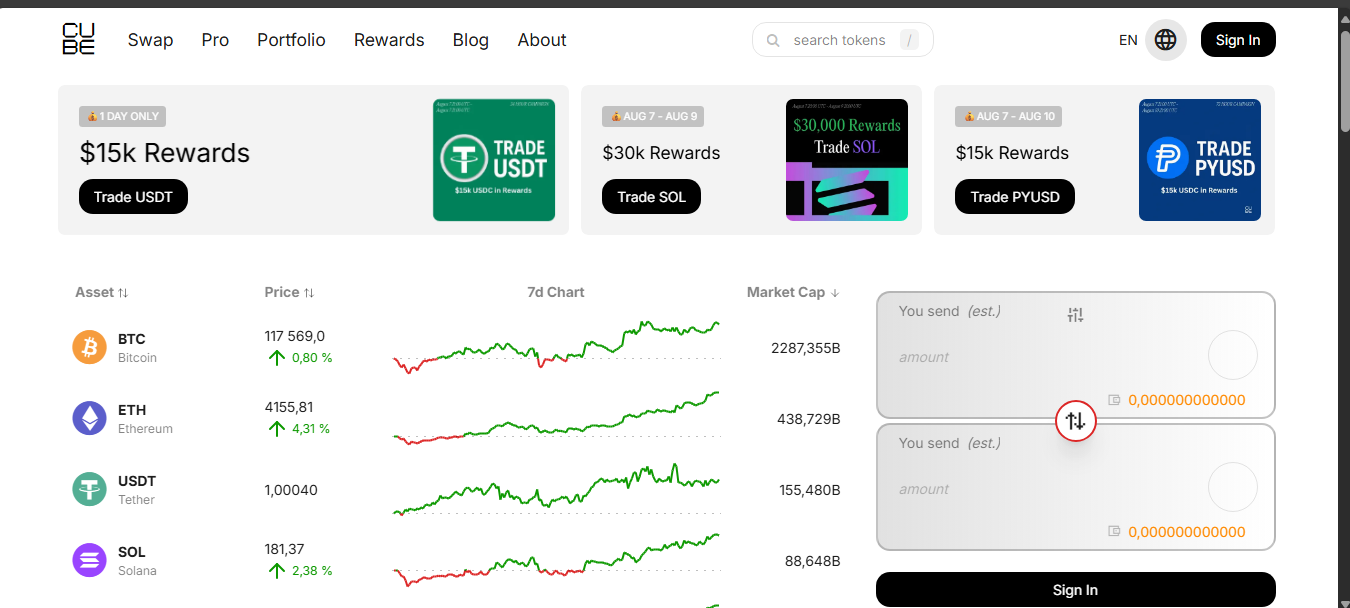

The setup Cube offers spot trading across multiple USDC pairs - USDT/USDC leads the volume charts, while BTC/USDC, ETH/USDC, SOL/USDC, and various niche tokens also trade. Total 24-hour volume sits in the low millions - indicative of early-stage adoption.

The design emphasizes low-latency execution with rich order types and real-time trading tools, mirroring traditional finance platforms but adding the custody safeguards of MPC.

Liquidity & Growth

Reports show recent 30-day volume around $135 million (~$1.6 billion annualized). That places Cube in the mid-to-lower tier among centralized exchanges, reflecting an early growth phase but not yet mass adoption.

Market-wise, Cube supports around 62 assets and 62 markets, with liquidity fading beyond the top USDC pairs.

Privacy, Regulation & Backing

Cube enforces KYC/AML standards to align with regulatory frameworks. Its MPC architecture ensures user funds remain under personal control, which builds confidence even in case of founder issues.

Snapshot View

Why Cube is Worth Watching

Cube stands out for merging custody autonomy with TradFi-grade speed. Traders gain access without surrendering asset ownership. Its architecture could reshape expectations for exchange design - but only if liquidity grows and adoption scales.

What to Watch

Growth and transparency are key unknowns. Volumes need to rise, especially beyond the core pairs. Proof-of-reserves or on-chain settlement data would add trust. Until then, Cube is best approached with cautious interest - great tech, but still earning its streets.

Final Thoughts

Cube Exchange shows ambition. It arrives with a bold premise: speed, security, and user control. Its MPC vaults and Guardian oversight set a new bar for exchange design. Liquidity is still modest, and adoption limited - but for traders who value custody and performance, Cube is a platform worth monitoring.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”

.png)

%203.svg)

%203.svg)