Honeyswap Exchange Review - Lean DEX with DAO Governance on Gnosis Chain

What Honeyswap brings to the table

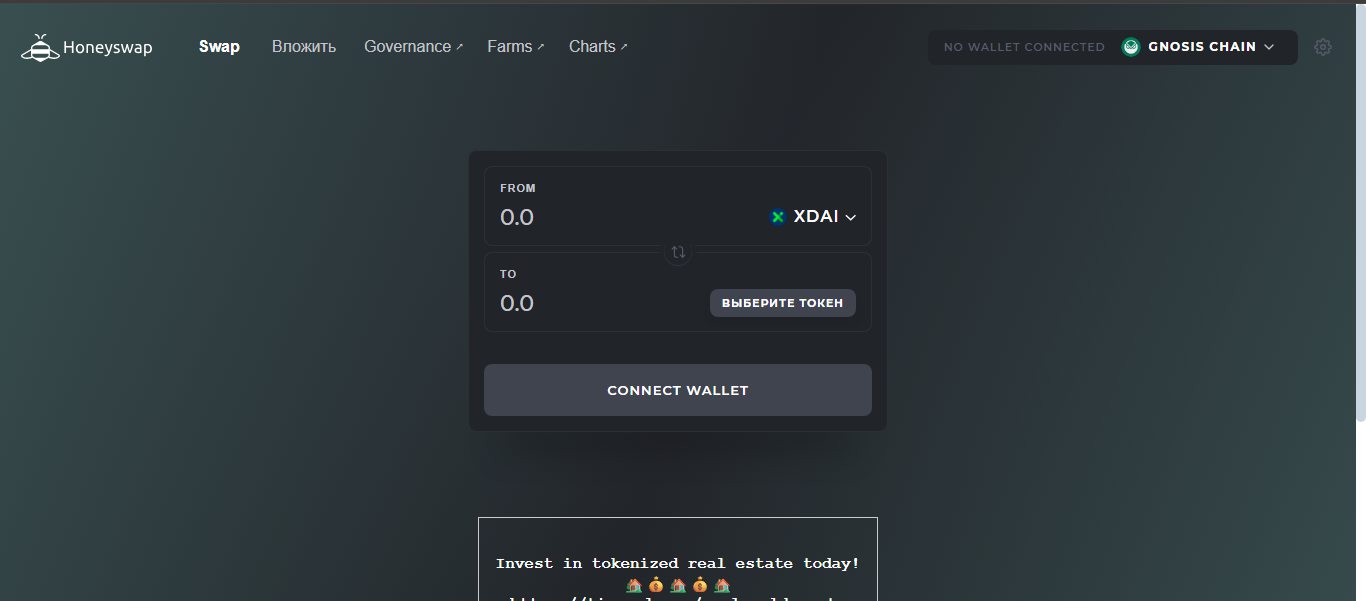

Honeyswap launched in September 2020 as a fork of Uniswap V2 on the Gnosis (formerly xDai) Chain, governed by the 1Hive DAO via the HNY token. It offers permissionless token swaps, liquidity provision, yield farming, and cross-chain bridges powered by OmniBridge. The interface is clean and wallet-connected, making it popular for low-cost trades and community-led governance.

Snapshot table

DEX mechanics and tokenomics

Honeyswap operates a classic AMM with a constant-product formula. Liquidity providers earn 0.25 % per swap and can stake LP tokens in Honeycomb farms for extra rewards. A 0.05 % protocol levy funnels into the DAO treasury. Farming incentives use COMB tokens, aimed at boosting sustainable TVL for community “gardens.”

Network efficiency and usability

Thanks to Gnosis Chain’s quick block times (~5 seconds) and PoS consensus, transactions are near instant and cost pennies in gas. A fiat-onramp via credit/debit is integrated, fee-free for small purchases, though off-chain KYC may apply. This makes Honeyswap a frictionless option for occasional traders.

Governance and decentralization

The 1Hive DAO oversees protocol changes, fund allocations, and front-end governance through the HNY token. Swarms within 1Hive collaborate on roadmap proposals and funding. Funds collected go into multisig-managed treasuries, incentivizing ecosystem growth via a community-driven model.

Activity, liquidity, limitations

Current TVL of ~$1 M and 24-h volume around $30 k signals modest liquidity. Only about 26–38 tokens and 38 pairs are active, meaning price impact on larger trades can be significant. This makes Honeyswap suitable for small to mid-size positions, but not ideal for high-volume users.

Risks & transparency

Honeyswap contracts have been audited and enjoy community trust, but overall protocol revenues are minimal (~$20k annual fees; no direct revenue for holders). The tokens and liquidity are relatively low, so any contracts or governance exploits could disproportionately impact the system.

Pros & cons

Pros

- Very low transaction costs on Gnosis Chain

- Clean, Uniswap-style liquidity pools and yield farming

- DAO governance with transparent fee flows to HNY holders

- Fiat on-ramp for easy small purchases

- Lean, community-driven ecosystem with rapid updates

Cons

- Limited liquidity and activity (TVL ~$1 M, volume ~$30 k/day)

- Small token selection and thin order depth

- Minimal protocol revenue and yield sustainability

- Governance and contract risks in a low-power DAO model

- Less suitable for large or institutional traders

Final take

Honeyswap shines as a nimble, cost-efficient DEX for small to medium-size decentralized trades on Gnosis Chain. Its DAO-controlled structure and farming model provide a genuine community feel. However, constrained liquidity and limited revenue growth mean it’s best for light-to-moderate users who value low fees and decentralization over scale.

If you’re navigating the Gnosis/xDai ecosystem, want cheap swaps, and don’t need deep liquidity, Honeyswap fits. But if you need volume, institutional-grade tools or wide token variety, mainstream DEXs or CEXs outperform here.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”

.png)

%203.svg)

%203.svg)