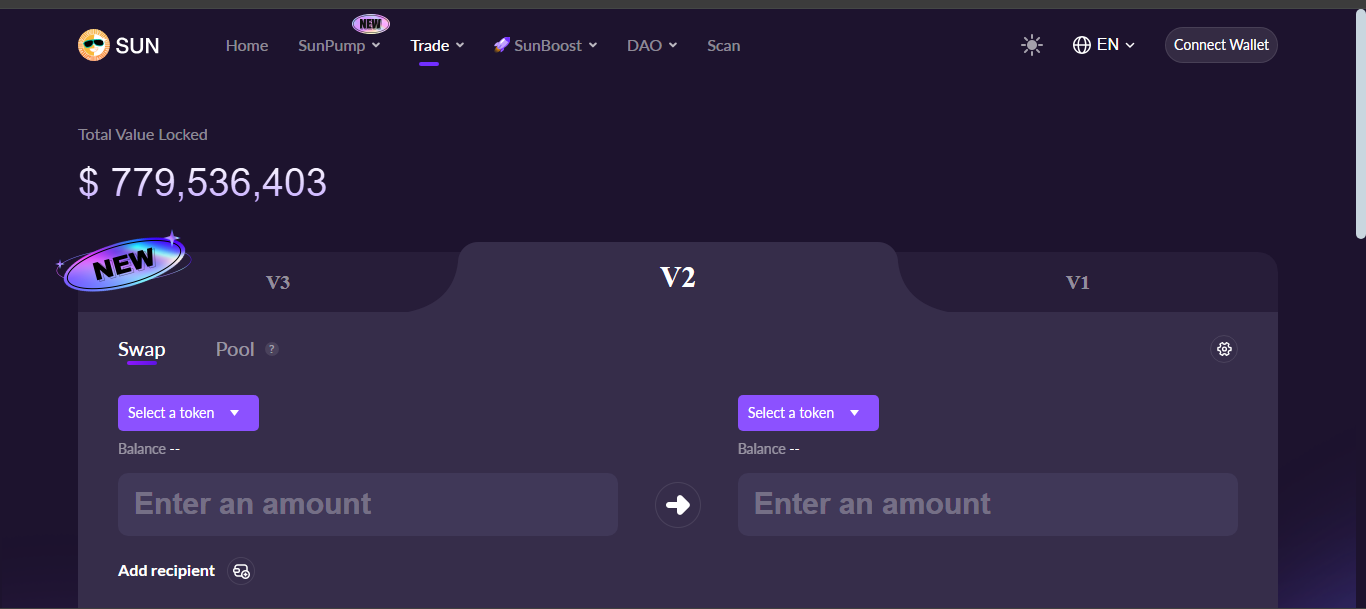

JustSwap Overview

JustSwap is Tron’s flagship DEX. It’s been around since mid-2020 and basically acts as the PancakeSwap or Uniswap for the Tron ecosystem. The interface is simple, swaps happen quick, and the whole thing is built around TRX and TRC-20 tokens.

What’s the Big Idea?

The main pitch is straightforward: give Tron users a place to swap tokens without going through a central exchange. You connect a wallet, pick your pair, and the platform finds a price from liquidity pools. No sign-ups, no third-party custodians holding your assets. It’s DeFi in its classic form - peer-to-peer swaps, everything visible on-chain.

Supported Assets & Volume

JustSwap covers all TRC-20 tokens. That means plenty of native Tron projects, stablecoins like USDT (on Tron), and various altcoins that launched in the Tron ecosystem. Daily volume has shrunk from early hype peaks, hovering now between $4 million and $10 million depending on market mood. Still, for small to medium trades, liquidity is fine on the main pairs. Stray into niche tokens, though, and you might move the price just by sneezing.

Fee Mechanics

Trading on JustSwap comes with a flat 0.3% fee. That’s standard for most Uniswap-style AMMs. Part of this fee pays liquidity providers, encouraging them to keep pools loaded. There’s no platform or admin cut beyond that. Gas fees are paid in TRX, and since Tron is cheap, you often see transaction costs that look laughable compared to Ethereum.

How It Handles Wallets & Custody

JustSwap is entirely non-custodial. You connect via TronLink or a similar wallet, sign transactions on the spot, and your tokens never sit in some exchange vault. This means you’re fully responsible for your private keys. Lose them, and there’s no support hotline to call. But it also means there’s zero counterparty risk from an exchange hack.

Liquidity Pools & Rewards

Anyone can add liquidity to JustSwap by pairing two tokens in a pool. In return, you get LP tokens that earn a slice of the swap fees. Some projects layer on farming incentives, paying extra rewards for staking those LPs elsewhere. It’s the usual AMM setup: the more you provide, the more fees you collect, but with the ever-present shadow of impermanent loss hanging overhead.

Pros vs. Cons

Highlights:

- Super low gas fees on Tron, pennies or less

- Easy swaps, no sign-ups, wallet stays in your control

- All TRC-20 tokens available, so native Tron projects are covered

- Anyone can add liquidity and earn on fees

Cons

- Daily volumes way down from early days, thinner liquidity on smaller pairs

- Impermanent loss risk for liquidity providers

- No fiat ramps - must come in already holding TRX or other tokens

- Stuck on Tron; not multi-chain like newer DEXs

Fast Facts Table

Who Might Like It

JustSwap is a no-brainer for folks already deep into Tron. If you’re holding TRX or stablecoins on this chain, it’s the default place to trade. It also suits people who want old-school DeFi simplicity: connect wallet, approve token, swap, done. No bells, whistles, or confusing bridges.

Bottom Line

JustSwap feels almost retro now - a pure AMM on a single chain, doing one job and doing it reliably. If you’re in the Tron world, it’s handy, cheap, and non-custodial. Just keep expectations realistic on volume and token choices. For more adventurous cross-chain farming, you’ll be looking elsewhere, but as a basic Tron swap hub, it still holds its ground.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”

.png)

%203.svg)

%203.svg)