MEXC - Big Exchange, Bigger Warnings

MEXC launched in 2018 and quickly gained traction. Over 2,000 tokens. Nearly 2,500 trading pairs. Billions in daily volume. It sounds like a trader’s paradise. But the deeper you go, the more red flags you find. KYC policies that shift mid-use. Locked accounts. Silent support. And no clear sense of who’s really in charge.

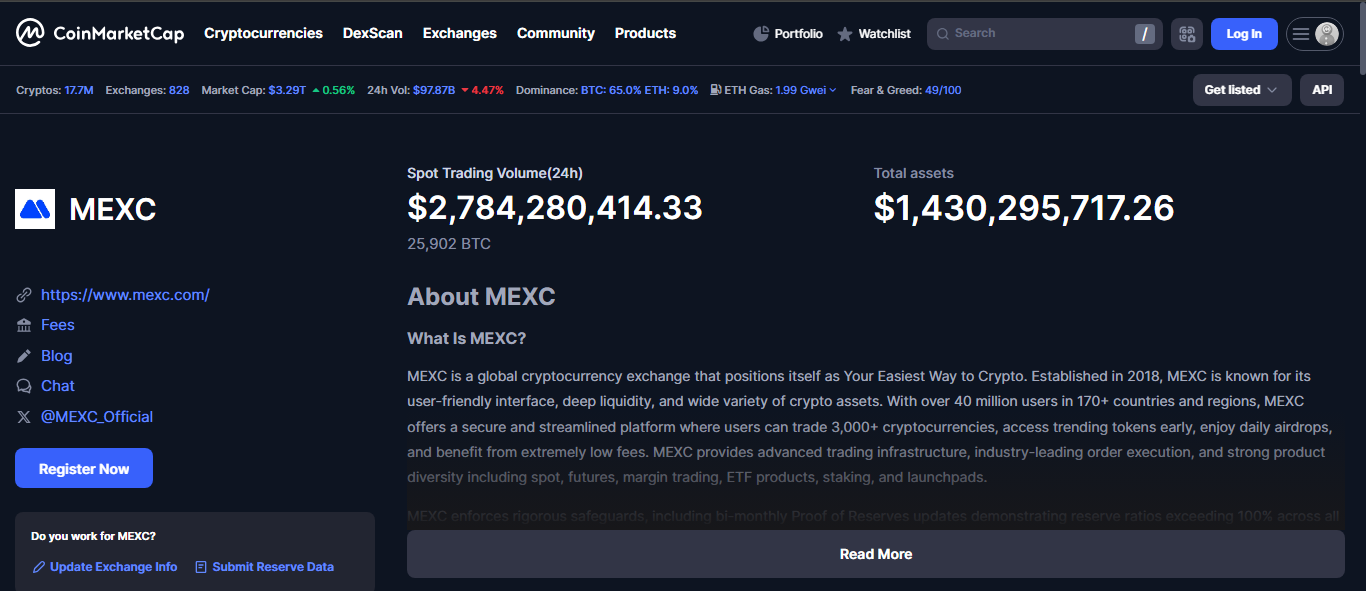

A Massive Catalog with Real Volume

Few exchanges can match MEXC’s scope. It lists more coins than almost any platform - memecoins, DeFi projects, NFTs, unknown microcaps. If you’re hunting for early listings or rare pairs, this is where you’ll find them.

Liquidity on major pairs is decent. Spreads are tight, slippage is low, and fills happen quickly. On the surface, the engine runs well. But that’s only part of the story.

Where It Starts to Crack

Users often praise the interface - clean, fast, mobile-friendly. Fees are low too. Spot trading can hit 0% maker and 0.05% taker. Futures are even cheaper. On paper, MEXC offers tools for everything: spot, margin, futures, staking, P2P, demo accounts, copy trading.

But problems begin when something goes wrong.

Support can be unresponsive. Tickets stay unanswered for days. Simple requests get generic replies. And if your account is flagged for “risk control,” withdrawals freeze with no warning.

KYC That Can Flip on You

One of MEXC’s selling points is optional KYC. You can trade and withdraw without verification - up to a limit. But that policy can change at any moment.

Many users report having their accounts locked after large withdrawals or sudden spikes in activity. Some say they were forced to verify their identity long after depositing funds. Others were asked to pay extra fees or wait for internal reviews.

This inconsistency erodes trust. It’s not about whether KYC exists - it’s about how and when it’s enforced.

Not Fully Regulated

MEXC claims global availability, but it avoids the U.S., China, and several other regions. It’s registered offshore, and while it references licenses, details are limited. That gives the platform freedom to move quickly - but also means fewer safeguards for users.

If your account is frozen, there may be no legal path to resolution. That alone puts it in a grey zone - operational, but not clearly accountable.

Community Reactions Are Split

Some traders love it. They trade daily, chase new tokens, and cash out without issue. Others share horror stories. Withdrawals blocked. Accounts shut down. No response for weeks. Even active users are warned to “never hold large balances here.”

The contrast is sharp. And where user experience varies this widely, caution is essential.

Strengths You Can’t Ignore

Let’s be fair. MEXC does a lot right:

- Extremely broad token listings

- Fast listing of new coins and trends

- Tight spreads and high liquidity on popular pairs

- Low fees across spot and futures

- Advanced tools and mobile support

- Non-KYC entry point with high initial limits

For fast, small-scale trading, it’s a useful platform. Especially for those who know how to manage risk.

Weak Points You Can’t Overlook

Here’s what hurts its reputation:

- KYC rules can change without notice

- Sudden account freezes with vague explanations

- Support delays or non-response

- Unclear legal framework and limited regulation

- No U.S. access, and limited protection for global users

It’s a system that works - until it doesn’t. And when it breaks, it breaks hard.

Who Should Consider MEXC?

It might suit:

- Day traders looking for variety and early listings

- Users who don’t mind staying under the KYC radar

- Risk-tolerant crypto explorers chasing hot coins

- Small-volume traders who can exit quickly

It’s not recommended for:

- Large holders keeping long-term positions

- Users in restricted jurisdictions

- Traders who need guaranteed access to funds

- Anyone expecting consistent customer support

Final Word

MEXC is one of the biggest exchanges by numbers. But the numbers don’t tell the whole story.

Behind the volume and the interface are rules that shift, accounts that freeze, and policies that leave users hanging. You can trade here. You can profit. But you need to be prepared. If you keep funds on the platform, watch them. If you use the features, test them. And never assume safety just because the UI looks clean.

MEXC is powerful - but power without accountability is a risk. Trade with care. And always have an exit plan.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”

.png)

%203.svg)

%203.svg)