RuDEX - Exchange Review

RuDEX launched in 2017 on the BitShares network, marketed as a decentralized exchange for trading crypto assets. Over time it gained minor traction but has since faded. Today it’s more of a ghost protocol than a live trading venue.

What It Claims

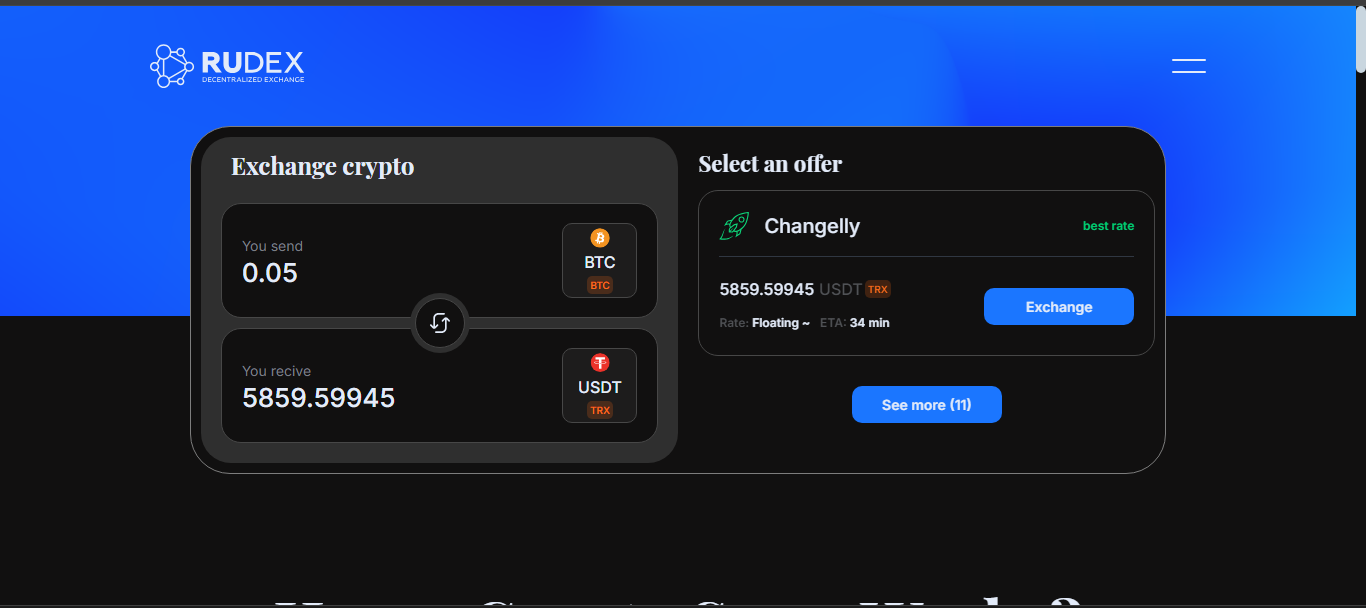

RuDEX brands itself as a no-frills trading platform:

- Centralized infrastructure built on BitShares

- Features basic order-book trading, price charts and simple UI

- Flat maker and taker fees around 0.05% - below industry norms

- No KYC, low withdrawal costs, and sparse fiat integrations

It promised clean access for small assets, especially in Eastern Europe, but couldn’t maintain volume.

Liquidity Fizzled

- Launched with around 14 coins and 28 trading pairs

- By early 2023, 24-hour volume had dropped to under $1,200

- As of mid-2025, reported volume is practically zero - under $200 per day

- TVL is unreported - reserves and balances are opaque

This signals an exchange that isn’t just struggling - it’s effectively dead.

Fees and Trading Experience

- Despite ultra-low trading fees, lack of users makes any order execution choppy

- With no liquidity, the order book is shallow and trades often fail

- Interface is minimal, with basic charts and no advanced tools

- No API or bot support - user experience has been phased out

Security and Structure

- RuDEX is controlled via centralized keys despite being called a DEX

- Fault tolerance is low - custodial risk remains

- Built on BitShares, which adds another layer of dependency

- No audits or bug bounties - smart contract risk remains unknown

Pros and Cons

Pros

- Historically low trading fees

- No KYC required for small trades

- Basic, clean interface with minimal design

Cons

- Essentially inactive - volume under a few hundred USD

- Centralized in disguise - not a true DEX

- No liquidity means slippage and execution issues

- No modern tools, API support, or audit transparency

- Limited coin variety compared to modern DEXs

Who, If Anyone, Should Use It

RuDEX no longer fits any real use case. Former users might explore it out of curiosity or nostalgia. In rare cases, leftover tokens might still sit in accounts. Otherwise, it’s not suitable for charting, trading, farming - nothing. Even hobbyists will find it devoid of activity.

Quick Stats

Final Word

RuDEX is a classic crypto relic - a once-promising platform now lingering with no users, no liquidity and no future plan. Its low fees and simple interface are overshadowed by centralized risks and inactive markets. Practically speaking, it’s a museum piece - not a functioning exchange.

If you’re looking to trade or farm, look elsewhere. RuDEX’s time passed years ago.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”

.png)

%203.svg)

%203.svg)