Skydrome (Scroll) - Exchange Review

Skydrome launched on the Scroll Layer-2 network, positioning itself as the first ve(3,3)-style AMM platform on that chain. It aimed to serve as a central liquidity hub with governance token SKY and a protocol design focused on rewarding liquidity providers.

Concept and promise

The project intended to integrate features like token swapping, LP incentives, on-chain voting, and redistribution of fees through SKY tokenomics - all under a decentralized model. It drew inspiration from Solidly and Velodrome designs, adapted for Scroll.

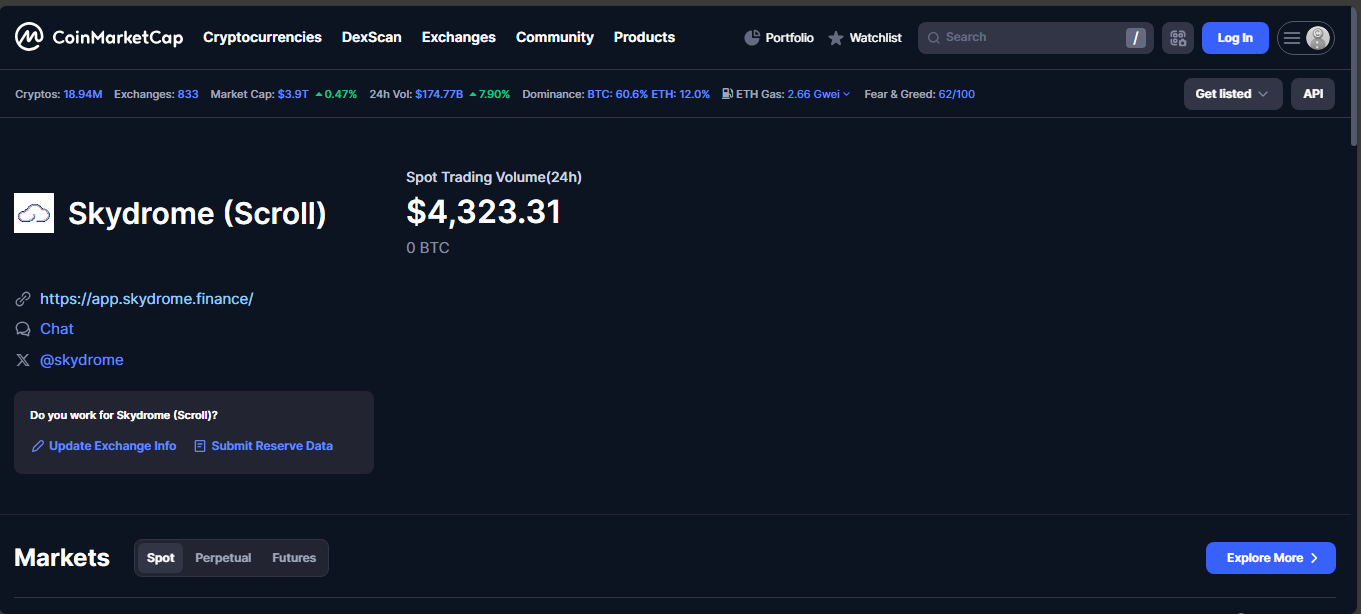

Volume, liquidity and token activity

Current available data shows extremely low volume: 24-hour trading volume ranges only between tens and a few hundred USD. Smart-contract analytics reveal negligible activity, with just a handful of transactions per day. Liquidity pools hold only a few thousand USD, making trading risky and slippage high.

Visibility and ecosystem context

While the Scroll ecosystem now includes several DEX platforms, Skydrome barely appears in rankings. Its Total Value Locked is around 85K USD, which is tiny compared to other Scroll protocols. Adoption and awareness remain minimal.

Security, transparency and trustworthiness

No formal audits or compliance reports are available. Contract risk flags include ownership not renounced and mint-burn privileges retained by developers. There are no user reviews or independent confirmations of safety.

Platform mechanics and fees

Reported maker and taker fees are near zero by design, but with such low trading activity, this claim is hard to verify. The platform requires wallet-based interactions and offers no fiat on-ramp or KYC process.

Community signals and coverage

Skydrome rarely appears in DeFi discussions. Community activity is almost absent, user ratings are missing, and web traffic is minimal. The project remains obscure with virtually no media coverage.

Pros and cons

Pros:

- Built on Scroll with innovative ve(3,3) design intentions

- SKY token designed for governance and LP rewards

Cons:

- Extremely low trading activity and liquidity

- TVL under 100K USD

- No audits or clear security measures

- Lack of transparency, trust, and adoption

Final thoughts

Skydrome is more of an idea than a functioning protocol. The concept of a ve(3,3) DEX on Scroll is appealing, but the reality shows minimal volume, shallow liquidity, no audits, and no active user base. At present, it resembles an experimental project rather than a reliable exchange. Anyone testing it should proceed with extreme caution and only risk small amounts.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”

.png)

%203.svg)

%203.svg)