Sphynx BRC - Exchange Review

Sphynx BRC was pitched as an all-in-one DeFi platform, combining trading, staking, farming and NFTs under one interface. It promised simplified use, multi-chain compatibility and low fees. On paper, it looked like a solid entry into the DeFi space. But the reality today is far from active.

Platform Overview

Originally deployed across chains like BSC, Bitgert, Cronos and Loop, the DEX aimed to serve as a central liquidity layer for emerging networks. Its interface was meant to offer token swaps, yield farming, staking rewards and NFT integration. The platform also issued its own token, SPHYNX, for governance and incentives.

But that vision never fully materialized. As of now, trading activity is zero, and most liquidity pools are inactive or abandoned.

Current Activity

- Total value locked: around $135,000 split across four networks

- 24-hour volume: zero

- Cumulative volume since launch: roughly $29.5 million

- Available pairs: not disclosed, presumed inactive

- Chain support: BSC, Cronos, Bitgert, Loop

- Audit status: none verified

In simple terms, the platform is dormant. No swaps are taking place, no liquidity is moving, and user interaction is effectively nonexistent.

Claimed Features vs Reality

Sphynx BRC promoted itself as a DeFi gateway with cross-chain routing, customizable farming, low trading fees, and on-chain governance. There were also mentions of NFT tools and a planned launchpad.

In practice:

- Swaps are offline or inactive

- Farms and pools appear to be empty

- NFT features are either deprecated or unreachable

- Governance is non-functional due to lack of user base

The tools may still be deployed, but there is no on-chain evidence of use.

Pros (Theoretical)

- Concept of multi-chain deployment was forward-looking

- Branded as beginner-friendly and fee-efficient

- Designed with modular DeFi features in mind

Cons (Actual)

- No live trading or LP activity

- Extremely low TVL across all networks

- No transparency on reserves, tokens or platform usage

- Lacks audit, bug bounty, or basic user protections

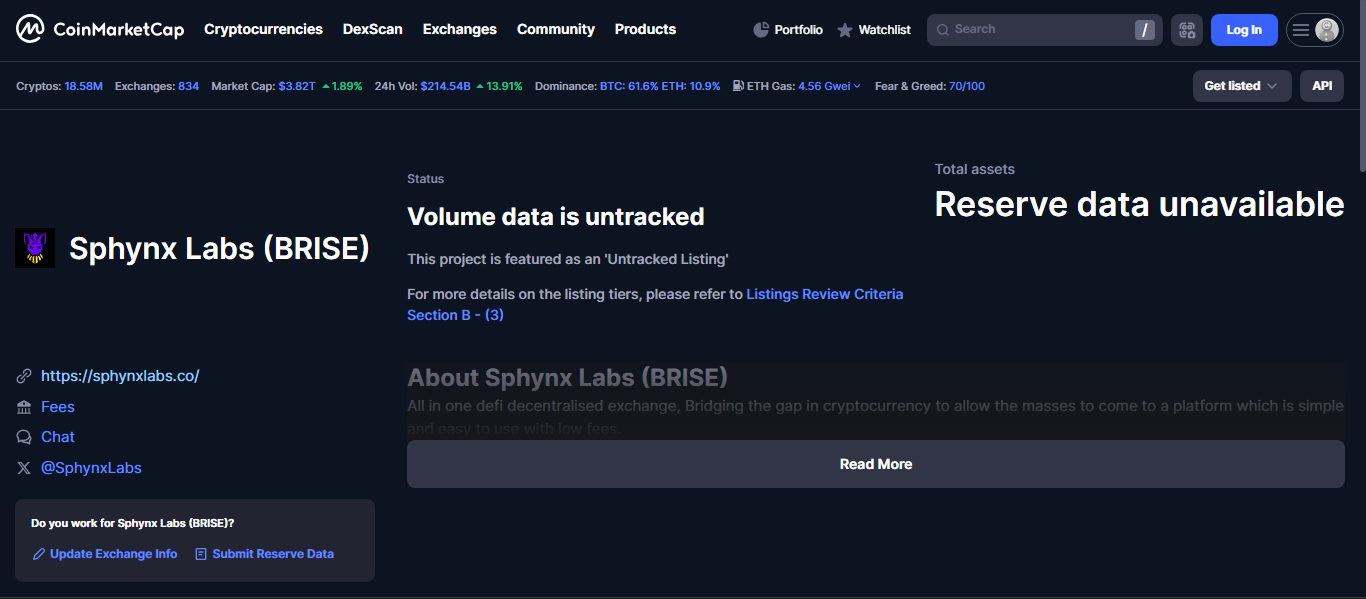

- Untracked and unsupported on major analytics platforms

Risk Breakdown

- Smart contract risk: code has not been audited or tested at scale

- Liquidity risk: pools are empty, slippage impossible to calculate

- Centralization risk: unclear who controls or maintains infrastructure

- Abandonment risk: platform appears to be inactive with no roadmap updates

Who Might Use It

At this point, the platform isn’t usable in any meaningful way. The only audiences who might benefit are:

- Developers researching failed multi-chain DEX architecture

- Analysts building datasets on inactive protocols

- Not recommended for traders, LPs, or yield seekers

At-a-Glance Metrics

Final Verdict

Sphynx BRC had the structure and messaging of a promising DEX, but never gained traction. With no trading volume, tiny locked capital and zero community activity, the exchange is effectively non-functional. Unless revived with new development, capital and audits, it remains a ghost platform - one best avoided by retail users and professionals alike

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”

.png)

%203.svg)

%203.svg)