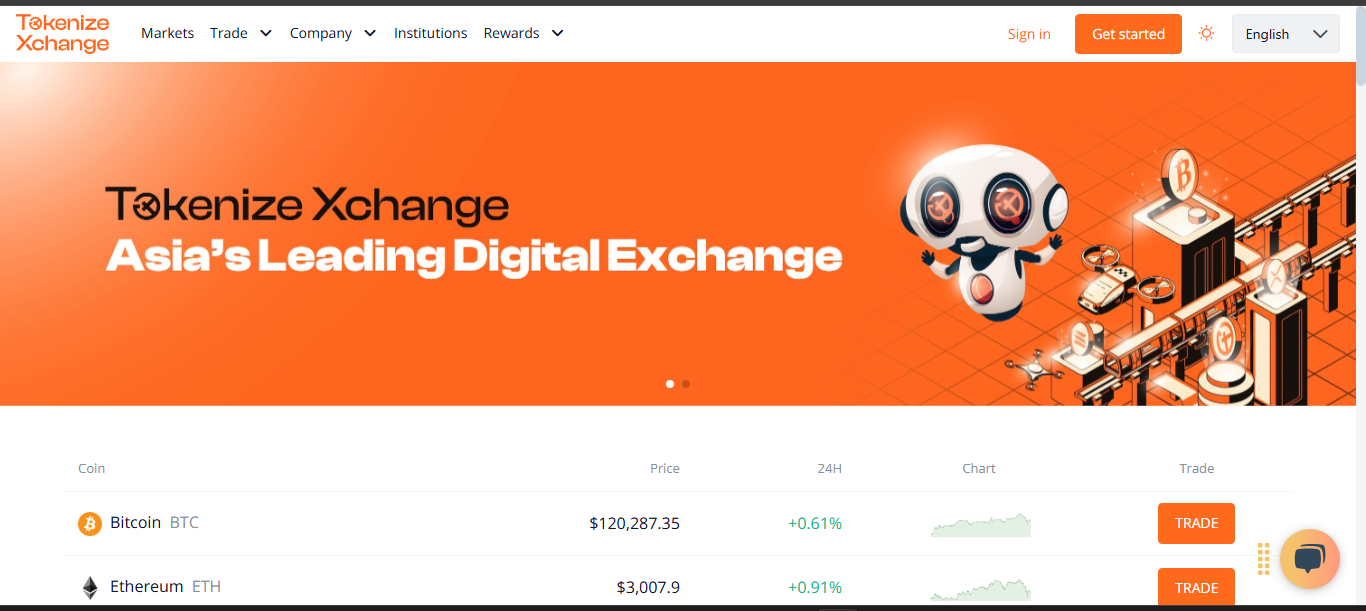

Tokenize Xchange Review

Who they are

Tokenize Xchange kicked off in Singapore back in 2018. It’s part of a bigger push by Tokenize Technology to bring tokenized assets and crypto into everyday finance. The exchange is properly licensed under Singapore’s Payment Services Act, so it operates with strict oversight from the Monetary Authority of Singapore. That regulatory base is a big selling point for both retail traders and institutional players who want local compliance locked in.

What they offer

The platform handles spot trading across roughly 70 to 100 pairs, mostly anchored by big names like BTC, ETH and major stablecoins. You can fund your account with SGD, USD, THB or PHP using local bank wires or cards, which makes it super friendly for traders around Southeast Asia. Withdrawals and deposits in local currencies are quick, a real advantage over global platforms that sometimes ignore these fiat rails.

Beyond standard trading, Tokenize offers tokenized versions of gold and real estate. It’s still early - volumes are thin - but it points to where they’re headed. They’ve also layered in staking so you can earn passive returns on supported coins. Fees follow a tiered maker-taker model that rewards higher volume with lower rates, keeping costs fair for regular traders.

Quick snapshot

It’s clearly aimed at being an all-in-one regional solution with crypto, fiat and traditional asset bridges in one spot.

Where it shines and where it doesn’t

Pros

- Solid regulatory backing in Singapore gives peace of mind

- Direct deposits and withdrawals in multiple Southeast Asian currencies

- Tokenized assets add a taste of future on-chain investing

- Built-in staking for extra earning on idle coins

- Institutional-level custody and compliance open the door for bigger players

Cons

- Liquidity isn’t huge - big orders on smaller pairs might see price jumps

- Tokenized real estate and gold are niche and don’t yet attract major flows

- The coin list is much shorter than global giants with thousands of pairs

- Staking yields are decent but don’t match pure DeFi platforms

- No derivatives, margin or heavy pro tools for leverage fans

Day-to-day experience

Account creation is pretty typical - submit KYC, wait for approval, then you’re set. Funding with SGD, THB, PHP or USD is simple, no need to bounce through third-party services. Trading sticks to familiar limit and market orders. Staking lives right in your dashboard, so there’s no need to mess with outside wallets or protocols.

Institutional customers get API access and secure custody features. Retail users mostly appreciate that it’s local - the fiat ramps, the license, and the straightforward dashboard. The tokenized asset section is still in proof-of-concept mode, so don’t expect deep markets yet.

The bottom line

Tokenize Xchange is best for Southeast Asian traders who want a regulated local exchange that takes fiat deposits, runs secure staking and is starting to explore tokenized real-world assets. It’s a great fit if you’re dealing in SGD, THB or PHP and want a one-stop shop without moving money across multiple apps.

But if you’re chasing huge altcoin lists, deep liquidity or advanced leverage tools, you’ll be better off looking at global mega platforms. Tokenize is carving out its own niche as a regional hub that bridges crypto with familiar fiat and early-stage on-chain assets - and for many local traders, that’s exactly enough.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”

.png)

%203.svg)

%203.svg)