WenX Exchange Review – intriguing features, but major red flags

WenX launched in early 2020 out of Singapore. It set out intending to serve both casual crypto users and more serious traders. The platform offers spot trading, perpetual contracts, leveraging, even tokenized ETFs and a grid trading bot dubbed “Lucky 8.” However, the most glaring issue is the near-absence of trading volume and public audit data - raising immediate concerns.

What you can actually trade

On WenX, users can trade major cryptocurrencies in spot markets. There are also perpetual futures with leverage up to 100×. The platform also added some lesser-known tools like tokenized ETFs (long/short leverage tokens), OTC fiat services, and a bot feature marketed toward sideways markets. Account setup includes KYC and a security layer that goes as far as “3FA” in certain cases. These products sound promising, but they remain hard to validate in real-world use.

Pricing, fees, and promos

Trading fees are marketed at 0% to 0.2% depending on your role as maker or taker. There’s an overnight position fee of around 0.1% for perpetuals. Users can tap into referral incentives, discount token options, and participate in bot and ETF products for additional bonuses. The fee system is straightforward - but without seeing actual trading dynamics, it’s hard to know whether these rates are truly competitive or buried in spreads and slippage.

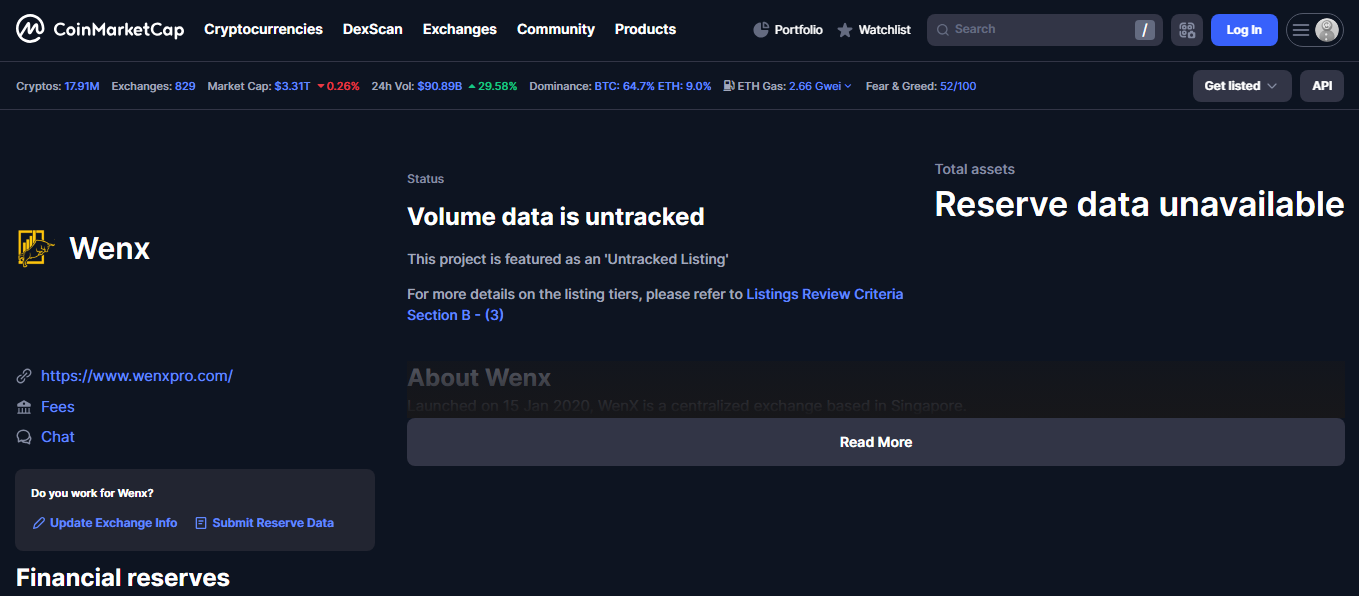

The missing data problem

This is where WenX really raises eyebrows. Trusted public sources report zero recorded trading volume, identify the listing as ‘untracked,’ and show no proof-of-reserve data or third-party audits. That makes it tough to know if there’s even real activity on the platform. With no real market depth visible, placing large orders could wipe out liquidity - or worse, the platform could simply be empty.

Trust issues and user feedback

Public chatter is fragmented at best. Some say WenX has never shown any actual trading numbers. A community thread from a few years ago warned of stalled withdrawals, frozen interest products, and product extensions without user opt-in - factors tied to exit-scam behavior. Those are classic red flags. The platform does claim advanced security infrastructure, and there’s mention of a former senior executive from a big exchange, but operational stories are thin.

Key strengths and major concerns

Strengths

- Diverse offerings: spot, futures, leveraged tokens, OTC services

- Account security includes multi-factor authentication

- Tools like leveraged token ETFs and a grid bot for market play

Concerns

- No public trading volume or liquidity data

- No independent audit or verified reserve report

- User reports from a few years ago mention withdrawal delays and account issues

- Trust rests almost entirely on internal statements, with external validation lacking

Who WenX might appeal to

If you’re willing to experiment and only trade small amounts, WenX might look attractive thanks to its feature set. It covers a lot of ground - scrolling through contracts, staking, bots, and tokenized ETFs. But remember, none of it is backed by clear liquidity or independent checks. If your trades matter, or if you're planning to move significant amounts, this lack of transparency is a serious risk.

For professional or high-volume traders, the absence of public reserves and volume data alone is a deal-breaker. Regulatory oversight is also missing, so any customer protections would rely on internal policy rather than external bodies.

Final take

WenX offers a broad menu of services - from spot and perpetual markets to tokenized products and automated bots. But the biggest issue isn’t what it offers - it’s that there’s no way to confirm whether anything actually works as advertised. Without volume metrics, audit reports, or independent user verification, you're essentially trading in the dark.

If you want to test the platform for novelty or feature-chasing and only risk small amounts, it could be an experiment worth trying. But for anyone looking for scale, reliability, or proven liquidity, WenX currently reads more like a project than a proven exchange. Proceed only with care and awareness of the gaps involved.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”

.png)

%203.svg)

%203.svg)